Market & Economic Commentary

Economic and Investment Outlook Summary - 2024

Feb 16 2024

At the start of each year, our investment team puts aside time to read and dissect the investment outlooks from all the major banks and investment houses. Last year we shared a summary of the main forecasts and expectations ( please click here to read the article). Let’s refresh our memory in light of what happened over the past 12 months.

2023: A Year in Review

Going into 2023 the forecasted growth figures were relatively pessimistic. Therefore, it is unsurprising that most major economies beat these expectations. Higher growth also led to central banks taking interest rates higher than expected and remaining at these levels for longer than previously forecast. Across all regions, the rate of inflation came down as anticipated and fell notably faster than expected, especially in the UK.

The outlook for global equities was mixed at the start of 2023 and despite continued volatility, stocks broadly performed well. Whilst analysts favoured the opportunities in Europe over those in the US, it was the latter that continued its usual dominance during 2023. Others cited opportunities in Japan, the UK, and emerging markets and, whilst the latter two delivered high single-digit returns, it was Japan that was the standout performer with local currency returns in the high twenties. As was anticipated, a change in central bank narratives towards the end of the year to a more accommodative stance (pausing or even looking to cut interest rates) created a catalyst to drive markets higher.

With higher yields available, fixed-income assets looked relatively attractive going into 2023 and overall, they delivered on these expectations. Whilst most outlooks suggested a preference for longer-term and higher-quality bonds, it was the riskier, lower-credit quality counterparts that performed the best as the economy remained more robust and interest-rate expectations came down towards the end of the year.

For the property sector, despite forecasts suggesting that higher interest rates and therefore increased borrowing costs would have a material impact, the sector remained surprisingly robust. Income returns remained stable; however, there was limited capital upside as the market continued to adjust to higher rates.

Overall, there were no major events or shocks during 2023. It is therefore unsurprising that forecasts and expectations were relatively accurate for 2023, apart from a few differences in the expected performance of certain assets. Looking ahead to this year, there is more opportunity for surprises and therefore, less certainty on the outlook. This is particularly true with the current geopolitical landscape and multiple elections occurring.

Outlook Summary for 2024

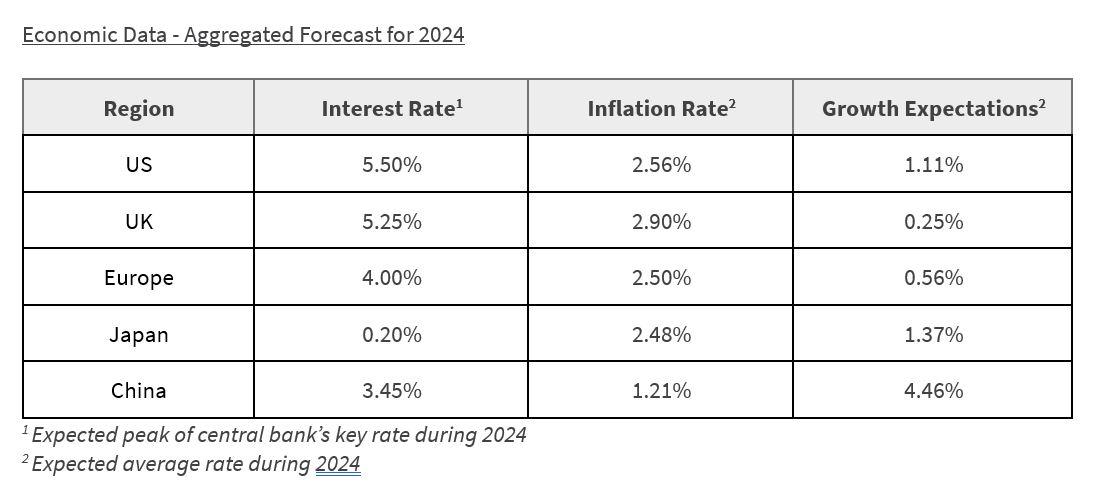

Please find this year’s summary in the table below. To see our more detailed outlook summary please click here Outlook 2024.

Economic Data

Heading into 2024, the forecasts suggest that interest rates in most major economies have reached their peak. An exception is Japan, which is expected to see its interest rates increase into positive territory after a prolonged period of negative figures. Inflation is expected to ease across the board, yet it may still exceed the central banks’ ideal target of 2%. Finally, economic growth is likely to decelerate within developed markets as the effects of now-tighter monetary policy feed through and post-pandemic tailwinds fade.

Equities

In 2024, the equity market outlook is varied. From a sector perspective, institutions have a neutral positioning in the US mega-cap tech stocks (which make up c. 18% of the global equity market) as, despite their strong performance last year and therefore higher valuations, they have maintained their robust earnings and good prospects for growth. In terms of overweight positioning, many are tilting towards financials and consumer cyclicals which have been priced for a less-favourable growth outlook and will potentially see the most uplift from continued economic growth. Geographically, the US is favoured for its stable, large-cap stocks, while the view is that Europe presents potential for only moderate gains despite its undervaluation. The UK market is viewed optimistically, supported by attractive valuations and sector composition. In contrast, Japanese equities are approached cautiously due to their recent significant rally, suggesting limited room for further growth.

Fixed Income

Within fixed-income markets, the expectation is for yields to come down across all maturities, particularly in the US, Europe, and the UK. However, shorter-term yields are anticipated to come down more than their longer-term counterparts. The most attractive investment opportunities are seen in high-quality fixed-income assets, such as developed-market government bonds and investment-grade credit, as these are impacted the most by monetary policy changes. Despite attractive yields, the US still faces fiscal challenges and therefore longer-term Treasuries are viewed as less attractive. In comparison, European and UK bonds are favoured with expectations that they will lead the way with interest rate cuts and drive yields lower.

Alternatives

Many firms still favour retaining an allocation to alternatives within portfolios, particularly with so much geopolitical uncertainty this year. Firstly, many cite commodities as an effective hedge for inflation with oil, gold, and other metals benefiting the most from current trends. Additionally, hedge funds are seen as more attractive strategies compared to private equity, whilst commercial real estate has fallen out of favour given higher interest rates and working dynamics.

Overall Base Case

For 2024, expectations are set for a global economy with a more subdued inflation picture, reduced economic demand, and lower interest rates. With around half of the world’s population eligible to vote this year, including pivotal elections in the US and UK, uncertainty and therefore volatility is anticipated to be higher.

Given the outlook for geopolitics and the global economy, those investments at the highest end of the risk spectrum have the potential for high returns but remain susceptible to potential headwinds. However, those lower-risk investments should provide the potential for modest returns even accounting for any potential shocks or adjustments in monetary policy.

Written by Artem Dubas and Jonty Brooks

General Disclosures: This article is based on current public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. The price and value of investments referred to in this research and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur.Cornwall

01326 210131

enquiries@taylormoney.com

London

By appointment only

020 7167 6690

enquiries@taylormoney.com

Let us call you back

Taylor Money Wealth Management provides a bespoke service for high-net-worth individuals looking for a long-term wealth management relationship. Let us get to know a bit more about your financial situation by getting in touch to request a call back.